Apple Inc.

Supplier Financial Health Report

Overview

June 2024

USA

Incorporated Country

161,000

Number of Employees

A+

Credit Rating

31

Count of Investments

Five-Year Financial Trend Analysis for Apple Inc.

CONSTANT

Credit Trend

52.16%

Total Balance Sheet Growth Rate

4.88%

Total Debt Growth Rate

Apple's creditworthiness is also noteworthy, with a high credit rating of A+ and a credit score of 98, indicating excellent creditworthiness and a strong financial position. The credit trend has remained constant, which is a favorable sign, as it suggests financial stability.

The company has undergone seven funding rounds, raising a total of $11.70 billion. With 31 investments, Apple has shown a willingness to invest in various opportunities, which could contribute to its growth. The number of exits is 15, suggesting a more active approach to investments and exits.

Apple's balance sheet shows a significant increase, rising from $231.84 billion in 2014 to $352.76 billion in 2022, representing a 52.16% change. The cash trend has also shown a substantial increase, rising from $13.84 billion in 2014 to $23.65 billion in 2022, representing a 70.80% change. However, the short-term investments trend has shown a decrease, dropping from $40.39 billion in 2018 to $24.66 billion in 2022, representing a 38.95% change.

Total debt and liabilities have also increased, rising from $114.48 billion in 2018 to $120.07 billion in 2022, representing a 4.88% change and $5.59 billion, respectively. In contrast, stockholders equity has decreased from $107.15 billion in 2018 to $50.67 billion in 2022, representing a 52.71% change.

Net income and EBITDA have also shown significant growth, rising from $39.51 billion in 2014 to $99.8 billion in 2022, representing a 152.60% change for net income and $87.05 billion in 2018 to $133.14 billion in 2022, representing a 52.95% change for EBITDA. Net operating cash flow and free cash flow have also shown substantial growth, rising from $59.71 billion in 2014 to $122.15 billion in 2022, representing a 104.56% change for net operating cash flow and $64.12 billion in 2018 to $111.44 billion in 2022, representing a 73.80% change for free cash flow.

Apple's operating cash flow per share has also shown a significant increase, rising from $3.87 in 2018 to $7.48 in 2022, representing a 93.25% change. The company's foreign revenue is also diversified, with China being the largest market, contributing 17.85% of Apple's revenue in 2022.

In conclusion, Apple Inc.'s financial health is robust, with substantial revenue growth, excellent creditworthiness, and strong financial position. The company's willingness to invest and its diversified revenue streams position it well for continued growth in the Consumer Electronics, Hardware, Mobile Devices, Operating Systems, and Wearables industries.

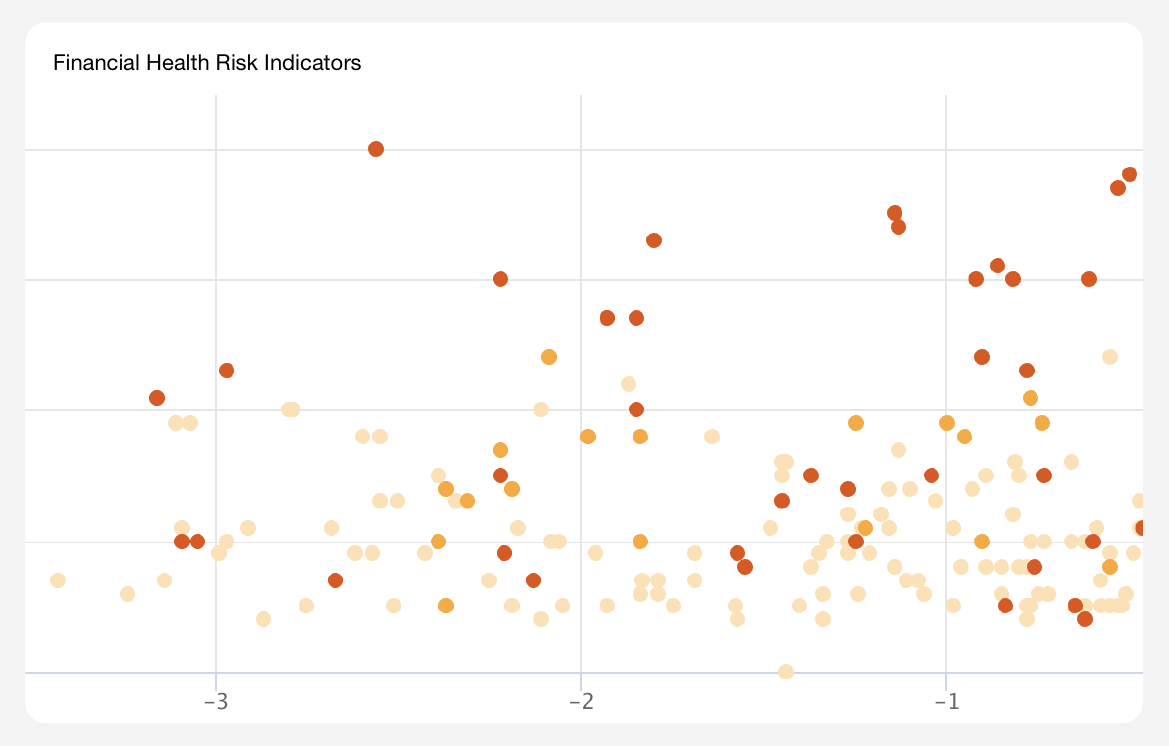

Financial Health Risk Assessment for Apple Inc.

LOW

Credit Risk

LOW

Bankruptcy Risk

MEDIUM

Financial Health Risk

Apple's creditworthiness is also noteworthy, with a high credit rating of A+ and a credit score of 98, indicating an excellent creditworthiness and a strong financial position. The company has undergone seven funding rounds, raising a total of $11.70 billion, and has shown a willingness to invest in various opportunities, which could contribute to its growth.

However, Apple's balance sheet shows a significant increase, rising from $231.84 billion in 2014 to $352.76 billion in 2022, representing a 52.16% change. The cash trend has also shown a substantial increase, rising from $13.84 billion in 2014 to $23.65 billion in 2022, representing a 70.80% change. However, the short-term investments trend has shown a decrease, dropping from $40.39 billion in 2018 to $24.66 billion in 2022, representing a 38.95% change. Total debt and liabilities have also increased, rising from $114.48 billion in 2018 to $120.07 billion in 2022, representing a 4.88% change. In contrast, stockholders equity has decreased from $107.15 billion in 2018 to $50.67 billion in 2022, representing a 52.71% change.

Net income and EBITDA have also shown significant growth, rising from $39.51 billion in 2014 to $99.8 billion in 2022, representing a 152.60% change for net income and $87.05 billion in 2018 to $133.14 billion in 2022, representing a 52.95% change for EBITDA. Net operating cash flow and free cash flow have also shown substantial growth, rising from $59.71 billion in 2014 to $122.15 billion in 2022, representing a 104.56% change for net operating cash flow and $64.12 billion in 2018 to $111.44 billion in 2022, representing a 73.80% change for free cash flow.

Apple's operating cash flow per share has also shown a significant increase, rising from $3.87 in 2018 to $7.48 in 2022, representing a 93.25% change. The company's foreign revenue is also diversified, with China being the largest market, contributing 17.85% of Apple's revenue in 2022.

However, there are areas of concern that merit further investigation. The company's current ratio of 0.88 suggests a modest ability to meet its short-term obligations, which is below the industry average. Although Apple's significant cash reserves and strong brand positioning provide some comfort, this ratio is worth monitoring. Another concern is Apple's debt-to-equity ratio of 5.96, which is quite high, indicating that a significant portion of its assets are financed through debt. This could increase financial risk if interest rates rise or if Apple experiences a downturn in sales.

Additionally, while Apple's profitability ratios are solid, there is room for improvement in its cost structure, as indicated by its gross profit margin of 0.43 and net profit margin of 0.25. These ratios are in line with industry averages but could be higher, suggesting that Apple could be more efficient in using its resources to generate profits.

Lastly, although Apple's Altman Z-Score of 5.79 is well above the threshold for a safe rating, indicating a low probability of bankruptcy, it is important to note that this score is based on historical financial data. Economic downturns or unexpected events could impact Apple's financial health in the future. Therefore, it is crucial for the company to continue managing its costs, debt levels, and liquidity carefully to maintain its financial health and continue its growth trajectory.

List of UEIs for Apple Inc.

ABOUT SUPPLIER FINANCIAL HEALTH REPORTS

Ark provides definitive, consolidated analyses of every vendor, subcontractor, supplier, grant awardee, non-profit, and investment organization in the national security and defense sectors. Supplier financial health reports are AI-assisted analyses of the current health and stability of an organization, as well as the trends, trajectory, and risk indicators that partners and stakeholders need to know about.

Explore Additional Analyses

ABOUT ARK.AI

The Ark is the only software platform purpose-built for Defense Acquisition that leverages authoritative commercial data and AI-enabled Applications designed to solve Acquisition challenges. With the Ark, analysts and decision-makers gain the ability to manage Acquisition programs proactively, allowing them to unwind the legacy complexity and effectively field modern warfighting systems that compete with China.

The Leading Defense Acquisition Software.

OUR APPLICATIONS

AI-enabled Applications within The Ark reflect standard workflows across the Defense Acquisition Process. From Science & Technology to Modernization, these Applications allow for the execution of rapid, efficient, data-informed decisions, standardized reporting, and efficient workflow management. The Ark enables your team to transform Defense Acquisition into a strategic advantage.