Arrow Electronics, Inc.

Supplier Financial Health Report

Overview

June 2024

USA

Incorporated Country

22,100

Number of Employees

A+

Credit Rating

2

Count of Investments

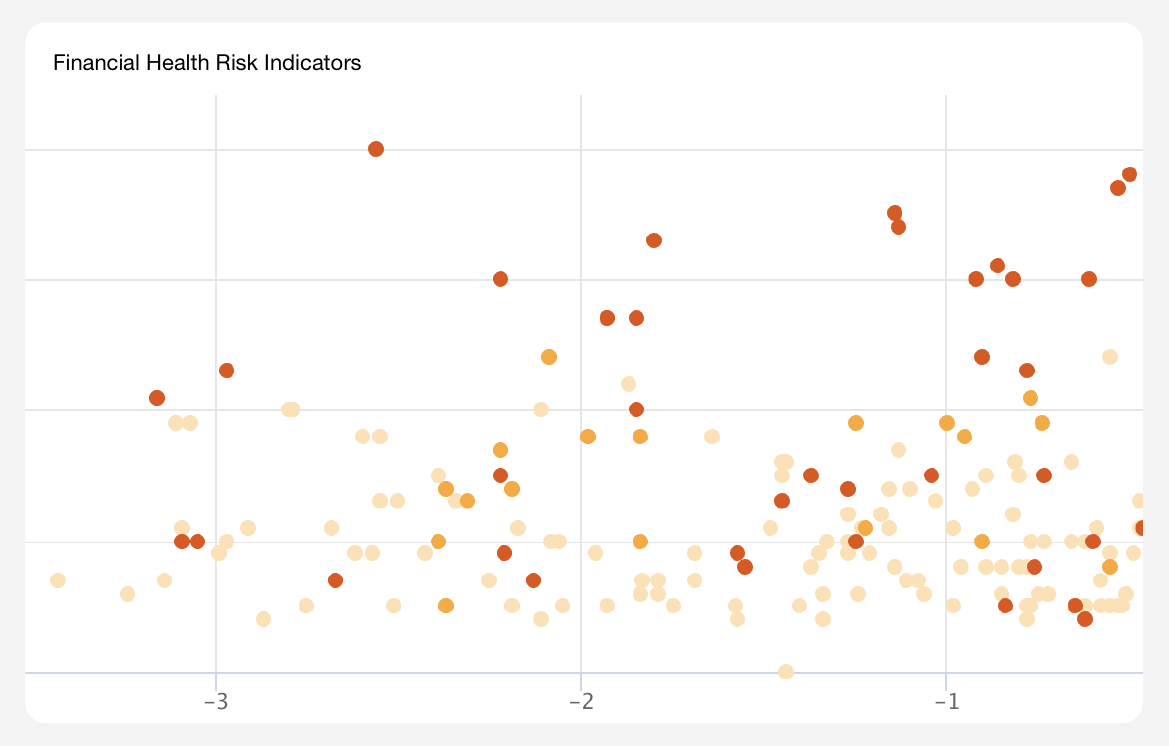

Five-Year Financial Trend Analysis for Arrow Electronics, Inc.

CONSTANT

Credit Trend

-20.15%

Total Cash Flow Growth Rate

28.13%

Total Debt Growth Rate

Arrow Electronics has experienced significant revenue growth, increasing from $168.8M in 2019 to $33.11B in 2023, representing a 19,513.69% change. The balance sheet also shows an increase, rising from $13.02B in 2015 to $21.73B in 2023, a 66.84% change. However, the cash trend has shown a decrease, dropping from $273.09M in 2015 to $218.05M in 2023, a 20.15% change.

The short-term investments trend has shown a substantial increase, rising from $36.9M in 2019 to $292.74M in 2023, a 693.32% change. The total debt trend has also increased, rising from $2.97B in 2019 to $3.81B in 2023, a 28.13% change. The liabilities trend has shown a dramatic increase, rising from $105.81M in 2019 to $15.85B in 2023, a 14,878.68% change. In contrast, the stockholders equity trend has shown a significant increase, rising from $244.04M in 2019 to $5.88B in 2023, a 2,308.38% change.

The net income trend has shown an increase, rising from $500.49M in 2015 to $909.36M in 2023, an 81.70% change. However, the EBITDA trend has shown a decrease, dropping from $281.7M in 2019 to -$192.99M in 2023, a 168.51% change. The net operating cash flow trend has also shown a decrease, dropping from $660.01M in 2015 to -$153.89M in 2023, a 123.32% change. The capital expenditures trend has shown an increase, rising from $150.81M in 2019 to $176.74M in 2023, a 17.19% change.

The free cash flow trend has shown a decrease, dropping from $358.1M in 2021 to -$330.63M in 2023, a 192.33% change. The operating cash flow per share trend has also shown a decrease, dropping from $1.65 in 2021 to -$1.44 in 2023, an 187.30% change.

Arrow Electronics derives a significant portion of its revenue from China (14.39%), Germany (13.11%), Japan (3.50%), India (2.97%), the United Kingdom (2.39%), France (2.21%), Italy (1.64%), the Russian Federation (1.56%), and the Republic of Korea (1.37%). Australia accounts for 1.36% of the company's revenue.

Despite the strong revenue growth and balance sheet increase, the decrease in cash, EBITDA, net operating cash flow, and free cash flow, as well as the significant increase in liabilities, raise concerns about the company's financial health. The decrease in operating cash flow per share and the large increase in stockholders equity also warrant further investigation. Overall, while Arrow Electronics has a strong credit rating and revenue growth, its financial trends suggest potential challenges that should be addressed.

Financial Health Risk Assessment for Arrow Electronics, Inc.

LOW

Credit Risk

LOW

Bankruptcy Risk

MEDIUM

Financial Health Risk

Despite the strong revenue growth and balance sheet increase, several financial trends raise concerns about the company's financial health. The decrease in cash, EBITDA, net operating cash flow, and free cash flow, as well as the significant increase in liabilities, indicate potential challenges that should be addressed. The decrease in operating cash flow per share and the large increase in stockholders equity also warrant further investigation.

According to the ratio analysis, Arrow Electronics' financial health appears to be generally strong, with a solid liquidity position, manageable debt levels, and a strong balance sheet. However, the negative net profit margin and low ROA and ROE ratios indicate areas for improvement in generating earnings and operational efficiency. The company's financial health risk is medium, with strong profitability and operational efficiency but moderate liquidity and solvency risks. It is important for Arrow Electronics to closely monitor its liquidity and solvency to ensure it can meet its short-term and long-term debt obligations.

Despite the strong credit rating, Arrow Electronics should address the identified financial trends to maintain its financial stability and competitiveness in the industry. The decrease in cash and negative net profit margin are particular areas of concern and require immediate attention. Further investigation into the reasons for the decrease in cash and the negative net profit margin, as well as the large increase in liabilities, is necessary to fully understand the company's financial situation and potential risks.

List of UEIs for Arrow Electronics, Inc.

ABOUT SUPPLIER FINANCIAL HEALTH REPORTS

Ark provides definitive, consolidated analyses of every vendor, subcontractor, supplier, grant awardee, non-profit, and investment organization in the national security and defense sectors. Supplier financial health reports are AI-assisted analyses of the current health and stability of an organization, as well as the trends, trajectory, and risk indicators that partners and stakeholders need to know about.

Explore Additional Analyses

ABOUT ARK.AI

The Ark is the only software platform purpose-built for Defense Acquisition that leverages authoritative commercial data and AI-enabled Applications designed to solve Acquisition challenges. With the Ark, analysts and decision-makers gain the ability to manage Acquisition programs proactively, allowing them to unwind the legacy complexity and effectively field modern warfighting systems that compete with China.

The Leading Defense Acquisition Software.

OUR APPLICATIONS

AI-enabled Applications within The Ark reflect standard workflows across the Defense Acquisition Process. From Science & Technology to Modernization, these Applications allow for the execution of rapid, efficient, data-informed decisions, standardized reporting, and efficient workflow management. The Ark enables your team to transform Defense Acquisition into a strategic advantage.