Dynavax Technologies Corporation

Supplier Financial Health Report

Overview

June 2024

USA

Incorporated Country

408

Number of Employees

A+

Credit Rating

15

Count of Funding Rounds

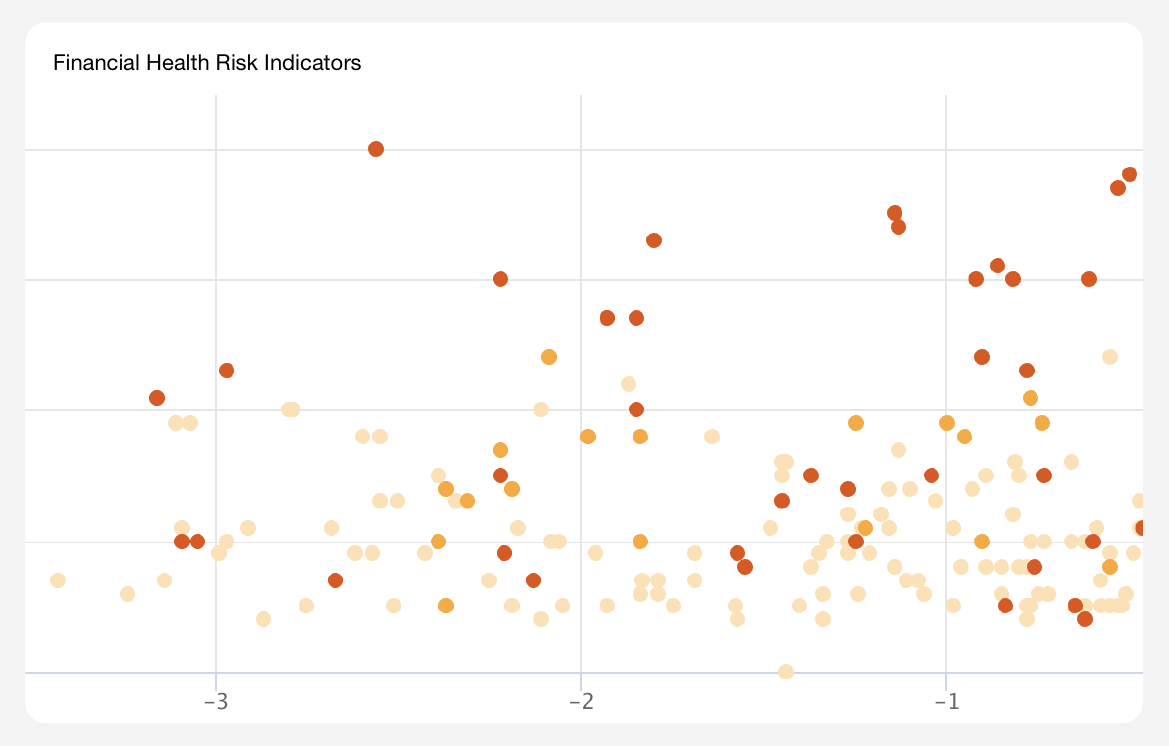

Five-Year Financial Trend Analysis for Dynavax Technologies Corporation

CONSTANT

Credit Trend

612.89%

Total Balance Sheet Growth Rate

119.66%

Total Debt Growth Rate

The balance sheet also reflects this growth, with a total balance sheet value increasing from $138.29M in 2014 to $985.85M in 2022, a 612.89% change. The cash trend has also shown a steady increase, rising from $49.51M in 2014 to $202M in 2022, a 308.00% change.

However, the total debt and liabilities have also seen a substantial increase, rising from $100.87M and $147.82M, respectively, in 2018 to $221.58M and $404.84M in 2022. This could be a potential concern, as it may indicate that the company is taking on more debt to fuel its growth.

Dynavax's credit rating stands at A+, and its credit score is an excellent 98, with a constant trend. These indicators suggest a strong financial position and low credit risk. The company has undergone 15 funding rounds, raising a total of $1.04B, which is a significant amount and indicates strong investor confidence in the company's potential.

The net income and EBITDA trends have also shown improvement, with net income rising from -$90.72M in 2014 to $293.16M in 2022, and EBITDA increasing from -$140.46M in 2018 to $295.61M in 2022. These trends suggest that the company's operations have become more profitable over the years.

In conclusion, Dynavax Technologies Corporation has shown impressive financial growth over the past five years, with a robust revenue trend, a strong balance sheet, and improving net income and EBITDA. However, the increasing debt and liabilities could be a potential concern and should be monitored closely. The company's credit rating and score, along with strong investor confidence as indicated by the number of funding rounds and total funding amount, further support the assessment of Dynavax's financial health.

Financial Health Risk Assessment for Dynavax Technologies Corporation

LOW

Credit Risk

LOW

Bankruptcy Risk

MEDIUM

Financial Health Risk

However, the total debt and liabilities have also seen a substantial increase, rising from $248.71M in 2018 to $626.42M in 2022. This could be a potential concern, as it may indicate that the company is taking on more financial obligations to fuel its growth. The debt ratio of 0.22 and debt-to-equity ratio of 0.7 indicate a moderate use of debt to finance operations. While this is not a cause for concern at present, it is worth monitoring as a higher reliance on debt could increase financial risk if the company experiences a downturn in revenue or if interest rates rise.

Despite the increasing debt, Dynavax's credit rating stands at A+, and its credit score is an excellent 98, with a constant trend. These indicators suggest a strong financial position and low credit risk. The company has undergone 15 funding rounds, raising a total of $1.04B, which is a significant amount and indicates strong investor confidence in the company's potential.

The net income and EBITDA trends have also shown improvement, with net income rising from -$90.72M in 2014 to $293.16M in 2022, and EBITDA increasing from -$140.46M in 2018 to $295.61M in 2022. These trends suggest that the company's operations have become more profitable over the years.

The financial data presented a strong financial position for Dynavax Technologies Corporation, with a current ratio of 6.11 and a quick ratio of 5.14, both significantly higher than the industry average. These ratios indicate that the company has more than enough assets to cover its short-term liabilities, suggesting a high level of liquidity and financial stability.

However, the moderate use of debt and the medium liquidity risk rating are worth monitoring to ensure the company remains financially sound. The Altman Z-Score of 2.3 falls in the grey area, indicating a moderate probability of financial challenges. While this is not a cause for alarm, it is essential to monitor this ratio closely as it suggests that the company may be facing some financial pressures. It's important to note that the Altman Z-Score is a predictive model and should not be the sole indicator of a company's financial health. Other factors, such as market conditions, competition, and management effectiveness, should also be considered when assessing the overall financial health of Dynavax Technologies Corporation.

In conclusion, while Dynavax Technologies Corporation has shown strong financial growth and a robust balance sheet, the increasing debt and liabilities, along with the moderate liquidity risk and the grey area Altman Z-Score, require further investigation. It's crucial for investors and stakeholders to keep a close eye on the company's cash flow and liquidity position to ensure it remains strong enough to support its operations and growth initiatives.

List of UEIs for Dynavax Technologies Corporation

ABOUT SUPPLIER FINANCIAL HEALTH REPORTS

Ark provides definitive, consolidated analyses of every vendor, subcontractor, supplier, grant awardee, non-profit, and investment organization in the national security and defense sectors. Supplier financial health reports are AI-assisted analyses of the current health and stability of an organization, as well as the trends, trajectory, and risk indicators that partners and stakeholders need to know about.

Explore Additional Analyses

ABOUT ARK.AI

The Ark is the only software platform purpose-built for Defense Acquisition that leverages authoritative commercial data and AI-enabled Applications designed to solve Acquisition challenges. With the Ark, analysts and decision-makers gain the ability to manage Acquisition programs proactively, allowing them to unwind the legacy complexity and effectively field modern warfighting systems that compete with China.

The Leading Defense Acquisition Software.

OUR APPLICATIONS

AI-enabled Applications within The Ark reflect standard workflows across the Defense Acquisition Process. From Science & Technology to Modernization, these Applications allow for the execution of rapid, efficient, data-informed decisions, standardized reporting, and efficient workflow management. The Ark enables your team to transform Defense Acquisition into a strategic advantage.