Supply Chain Analysis

FOCI and Compliance Risk

Department of Health and Human Services (HHS)

Updated March 2024

4

Primes with 889 or 1260H Compliance Violations

2,573

Chinese Connected Tier 1 Suppliers

88

Primes with Chinese Connected Owners or Investors

1,800

Active Contracts over $10M

FOCI and Compliance Risk: HHS

Top Companies with 889 or 1260H Violations

| Name | Dollars Awarded | Count of Awards | Count of Violations |

| Cepheid | $110,085,109 | 658 | 14 |

| Global Life Sciences Solutions USA LLC | $102,973,336 | 347 | 17 |

| AB Sciex LLC | $60,421,013 | 278 | 12 |

| Beckman Coulter, Inc. | $42,739,411 | 245 | 10 |

| Leica Microsystems Inc. | $31,646,959 | 633 | 29 |

Top Common Tier 1 Suppliers

| Name | Count of Common Primes | Dollars Awarded to Primes | Count of Prime Contracts |

| Carahsoft Technology Corp. | 101 | $844,932,867 | 1,636,367 |

| Booz Allen Hamilton Inc. | 69 | $2,494,940,471 | 36,722 |

| CDW Government LLC | 69 | $145,278,959 | 558,237 |

| Dell Marketing L.P. | 63 | $185,563,928 | 47,958 |

| Dell Federal Systems L.P. | 62 | $208,690,630 | 192,606 |

Top Contracts with Chinese Connected Suppliers

| Contract ID | Supplier Name | Dollars Awarded | Funding Office |

| 75A50223C00007 | Shanghai Runda Medical Technology Co Ltd | $97,492,573 | ASPR/DAAPPO/ORM HQ |

| HHSM500201300099C | Mercedes Benz Group Ag | $255,266,682 | Office of Acq and Grants Mgmt |

| 75N92020C00013 | Shanghai Runda Medical Technology Co Ltd | $90,620,000 | NIH/NIBIB |

| 75A50120C00028 | Sh Kaiwell Co Ltd | $28,513,805 | Asst Sec for Preparedness |

| N000142390001 | Ching Ming Aluminium Die Casting Manufactory Ltd | $28,505,000 | Asst Sec for Preparedness |

Top Primes with Non-U.S. Revenue

| Name | Non-US Revenue % | Dollars Awarded | Primary Funding Office |

| Pfizer Inc | 63.40% | $5,494,775,200 | HHS |

| Moderna Inc | 73.30% | $308,495,451 | HHS |

| Paratek Pharmaceuticals Inc | 51.60% | $224,607,279 | HHS |

| 3M Company | 57.60% | $188,607,499 | HHS |

| Basilea Pharmaceutica Intl Ag Allschwil | 93.40% | $88,633,507 | HHS |

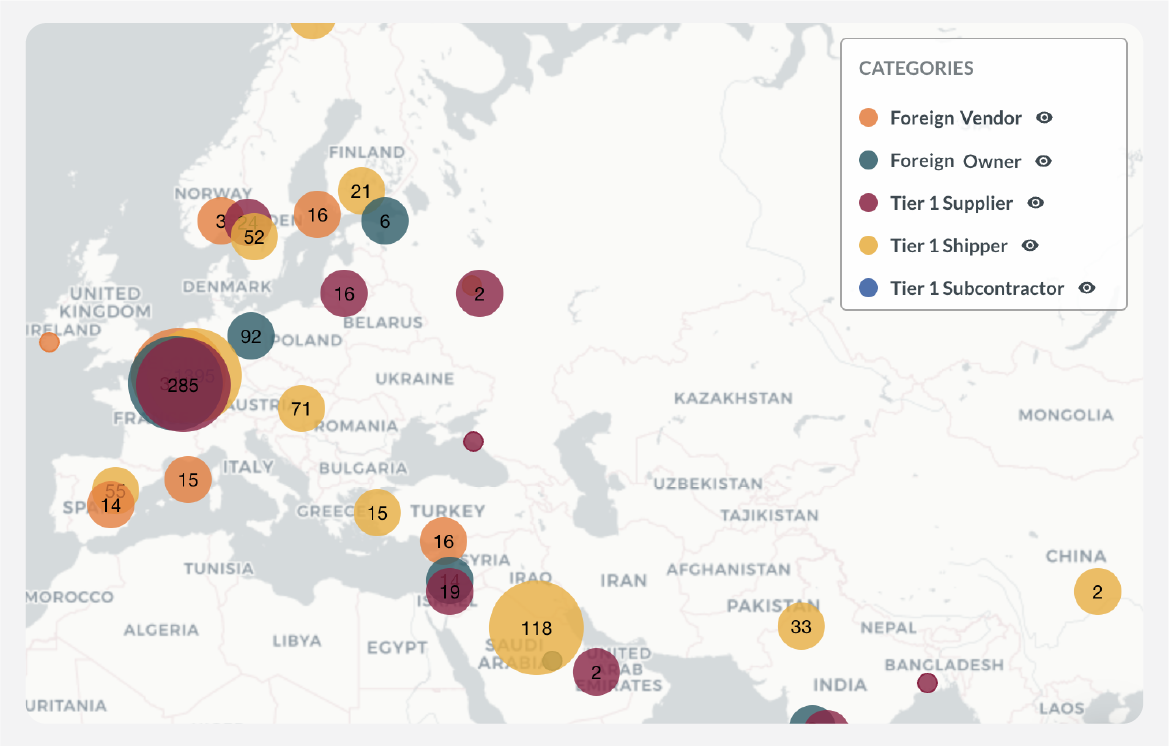

ABOUT FOCI AND COMPLIANCE RISK

Uncover foreign influence in vendor ecosystem across investors, ownership, key personnel, and geographic locations and unearth organizations in your ecosystem that are non-compliant with U.S. legislative regulations such as Section 889 or 1260H.

EXPLORE ADDITIONAL ANALYSES

ABOUT ARK.AI

The Ark is the only software platform purpose-built for Defense Acquisition that leverages authoritative commercial data and AI-enabled Applications designed to solve Acquisition challenges. With the Ark, analysts and decision-makers gain the ability to manage Acquisition programs proactively, allowing them to unwind the legacy complexity and effectively field modern warfighting systems that compete with China.

The Leading Defense Acquisition Software.

OUR APPLICATIONS

AI-enabled Applications within The Ark reflect standard workflows across the Defense Acquisition Process. From Science & Technology to Modernization, these Applications allow for the execution of rapid, efficient, data-informed decisions, standardized reporting, and efficient workflow management. The Ark enables your team to transform Defense Acquisition into a strategic advantage.